What ERP Means For Small Local Businesses In The Philippines?Category: ERP Technology Author: Rodel A.G. Sarmiento, MBA-MA, MBA, CIA, CPA, CISA-Passer Published: January 11, 2016 |

LEAN ACCOUNTING: Rebooting the Way We Analyze the CostsCategory: Business Management and Operations Author: Rodel A.G. Sarmiento, MBA-MA, MBA, CIA, CPA, CISA-Passer Published: November 14, 2011 |

About Us

What We Are

We are a small-sized general professional partnership of Certified Public Accountants engaged in the practice of audit, management advisory, business applications development, bookkeeping and other allied consulting services for the small and medium scale enterprises.

We bring value to our clients. We offer a personalize level of care where our Partners are involved not only from the entrance/exit meetings but throughout the engagement activity. We strive to provide proactive advice by presenting the situation, questioning the facts, offer practical alternatives and recommend based on those alternatives.

Our Mission

Our clients deserve nothing but the best from us. Our mission is to serve our clients with the highest quality of service without compromising our professional integrity and independence.

We treat our work seriously. By providing quality and timely business information, we bring value to our clients.

We will earn our client's trust if they are consistently satisfied with our service.

Our Vision

We will have our eye on small business solutions. We will develop business applications that will integrate with other applications and become scalable across functional modules. We aim that by the end of 2021, we will have complete modules for the enterprise resource planning systems to our core of professional services.

Our Approach

We work in close consultation with our clients. We learn as much as we can to help us understand their problems better by getting to its root cause and develop workable solutions based on our diagnosis. We strive to consider everything in our plan before we execute our moves to reduce any incidence of surprise that come along with our engagement. We check and recheck our work before handing out the solutions and strive our best to provide more satisfactory results to our clients without compromising the interest of the general public.

There is no panacea to all business problems. Not all engagements are the same. The business dynamics change for every industry, each problem must be approached in a unique way. There may be standard answers to common business problem but the solution may be delivered in many different ways for different business organizations. At ASCPA, we impose ourselves to deliver workable and sustainable solutions for our clients.

Our work does not stop on exit meetings with the client. We keep in touch with them by sharing the the latest news and events on finance, tax and certain business technology that can have significant impact on their business operations. We also assist them by providing on-going education thru webcasts, podcasts, knowledge management resources, online trainings and end user support.

Our Way of Thinking

We treat the business problem as a story. It has its main points as well as auxiliary points. We really want to see the whole picture of the problem before we pay attention to its details. It helps us point our target by solving the root cause of the problem. This is why we devote so much time in planning to increase our chance of achieving our target.

The whole picture of the problem has stories to tell. Each story has several tasks. These stories will tell which tasks depend on other tasks. By knowing our tasks, we know when and how to design our work programs before we dig into details. We remove the duplicate tasks, plot them in sequence and then we process to achieve the required output. By doing this, we focus on solving the most important parts of the problem.

Our Core Values

"The only thing that works is Management by Values. Find people who are competent and really bright, but more importantly, people who care exactly about the same things you care about."

Steve Jobs

What is a Core Value?

"A principle that guides an organization's internal conduct as well as its relationship with the external world."

Source: http://www.businessdictionary.com/definition/core-values.html

How Our Core Values Play Out in ASCPA's Mission and Vision?

It serves as the Company's DNA. The foundation of WHO WE ARE and WHAT WE ARE.

Why Are We Doing This?

To align our personal values with the Company's values by:

- TEACHING RECOGNIZING LIVING these core values.

- To educate our customers about our IDENTITY as a Company.

- To work with PURPOSE.

Excellence

- Work hard to improve ourselves.

- Deliberate practice.

- Listen to your fixed mindset voice.

Value

- Give the best you've got.

- Grow by embracing change.

- Never allow the moment to be a memory.

Listening

- Focus on the content.

- Understand the message.

- Appreciate the value of the message.

Passion

- Do the impossible.

- Surround yourself with passionate people.

- Become a self-learned expert.

Respect

- Demonstrate your character.

- Fit your attitude in the environment.

- Treat others seriously - even your enemies.

Integrity

- Say what we do. Do what we say.

- Write your commitment.

- Make your commitment important.

Our Firm History

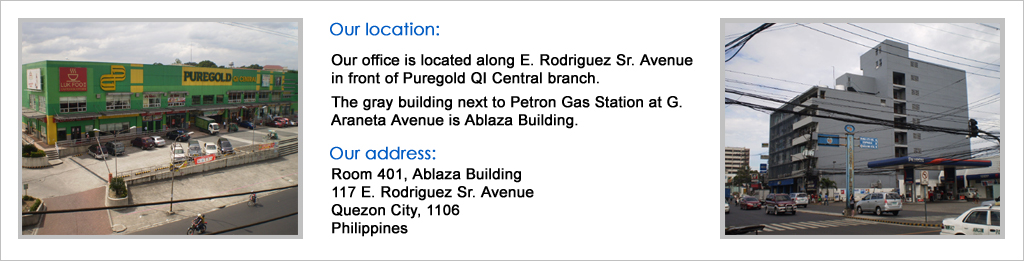

Aldana, Sarmiento and Co., CPAs, known as ASCPA, was formally established on October 25, 2007. ASCPA did not start its business right away. The founding partners thought long and hard of the business challenges they might face once the company would be up and running. Part of the initial business plan was to strengthen the Company's organizational capacity to fulfill its vision. To put this plan into action, one of the founding partners had to study and learn the American's work environment and bring home the technology knowledge and practical experiences on January 2011.

ASCPA's business took off on February 2011. We started with small bookkeeping, training and assurance engagements for NGOs and cooperatives. Few months later, we were slowly representing clients on financial reporting and business tax concerns and assisting start up clients on business registrations at DTI, BIR and SEC. On September 2012, ASCPA commenced its project audit engagements and outsourced internal audit works for the large foundation. We developed and sold our first software, the point of sale and consignment inventory tracking application, on March 2011 for a chain of retail stores nationwide to automate the retail store operations and generate consignment inventory transaction reports. Then the website development followed on October 2011 for the same client. ASCPA built its major application by developing the payroll system for a multinational company on January 2015 to automate the payroll transactions, compensation tax reporting at the BIR, upload template for SAP Business One general ledger entries, and file conversion for auto debit transactions to employees' respective ATM accounts. On June 2015, ASCPA commenced its internal project on module developments for ASCEND ERP Systems which we aim to integrate and finish by December 2018.

We officially changed our company name from Aldana, Sarmiento and Co., CPAs to Aldana, Sarmiento and Company, Certified Public Accountants and Consultants on February 21, 2012 at the Securities and Exchange Commission. We want our company name to reflect our goals for the immediate future - as both accounting service and business solutions provider for the small and medium scale businesses.

We view our future positively. If we consistently focus our business actions on achieving our vision, we have a chance to sell our suite of business applications as early as December 2018.

Our Partners

We're a lean and flat company so everyone has important roles to fill in. We're a team of less than five hardworking people from different professional backgrounds with one goal in mind - to satisfy our customers through quality work. More time and effort are needed to maintain customer satisfaction on a consistent basis.

We must setup the tone to our staff employees. We roll up our sleeves and get down to work right away. We come prepared and strive to learn as much as we can from one another especially from our clients and peers. We reinforce our knowledge and skills by challenging each other's ideas so we get the best practical solution for every business concern that come our way. This is how things are done and will always be done in ASCPA from the Partners to their support staff.

Del

Rodel Augusto G. Sarmiento

Co-Founder and Managing Partner

Rodel Augusto G. Sarmiento

Co-Founder and Managing Partner

Software Developer - ASCEND Business Solutions

Email: [email protected]

Telephone: +632 296 6436 / +632 253 9344

Education

Master in Management AccountingMaharishi University of Management

Iowa USA (2011)

Master in Business Administration

Ateneo Graduate School of Business

Makati City Philippines (2004)

Bachelor of Science in Accountancy

University of San Jose Recoletos

Cebu City Philippines (1994)

Q. What are your biggest priorities for ASCPA?

I have three most important priorities to address:- Find and develop the right talents for our ERP development project. They have to mesh our core values to improve team chemistry..

- Develop the knowledgebase for search and retrieval of organizational data for internal use and integration with ERP small business applications.

- Increase seed funding to support our manpower requirements for software development and IT infrastructures.

Q. Why is it important that you address those priorities?

To increase our chances of achieving the ASCPA's vision in 2018.Q. Why pursue on development of business applications for ASCPA?

Business process automation for faster service delivery, improved quality and increasing the bottomline.Q. What is the goal of your business proposition?

Most small and medium scale enterprises have limited resources to spend on technologies that will help them on these areas. Leveraging on performance of existing functionalities of off-the-shelf small business applications will become limited as their business grows and organizational processes become more complex. We believe there is potential market for this gap. Approximately 65% of the businesses in the Philippines are small and medium scale enterprises. Scaling up their IT needs by combining proprietary and open-source systems will maximize their IT resource utilization without investing much on new technologies.By bundling our accounting services with business applications, we can offer more value to our services. Our knowledge, skills and experience in accounting, consulting and ERP technology will be more beneficial to small businesses. This is what we want in the immediate future.

Q. What drew your interest to ERP technology?

I forced myself to learn ERP while doing my new jobs in 2005 as Manager in Accounting and Finance and as core member of the ERP project implementation team. It was very frustrating that our ERP Consultants failed to guide the project management team who had no experience in ERP project management. What made it harder for me was all the erroneous activities from Logistics, Production, Customer Service, Credit and Collection and Treasury spilled over to General Ledger. I had to figure out the inner workings of this ERP software to understand how the accounting entries were posted and affected the general ledgers and financial statements. This painful experience drew my interest to learn more about programs and databases. My practical experience in business analysis supported my ERP knowledge and skills especially on programming, database, networking, data analysis, business intelligence and information security.Q. What valuable advice can you give to our aspiring developers and accountants?

Believe in your great work. You cannot push the envelope unless you have confidence at what you do. At times there will be people or circumstances that will put you down and you must endure the unrelenting challenges or perhaps unbearable embarrassment that comes along with your work. Stay on course. Believe your work will succeed along the way.Audit Experience

Aldana, Sarmiento and Company (2011-present)Diaz Murillo Dalupan, CPAs (1995-1997)

Industries Served

CooperativeEducation

Engineering and Construction

IT Consultancy

Logistics

Manpower Services

Manufacturing

Microfinance

Non-Profit

Printing and Advertising

Real Estate Development

Retail

Professional Affiliations

Former Board Member, League of NGO Accountants for Development (LEAD)Member, Information System Audit and Control Association (ISACA)

Member, Institute of Internal Auditors - Philippines (IIA-P)

Member, Philippine Institute of Certified Public Accountants (PICPA)

Certifications

Certified Information Systems Auditor - Passer (2014)Certified Internal Auditor (2013)

Financial Accounting and Reporting - California USA CPA Exam (2010)

Business Environment and Concepts - California USA CPA Exam (2008)

Microsoft Dynamics 4.0 Finance Series (2008)

Certified Public Accountant - Philippines (1998)

Ella

Nataniela Aldana-Sarmiento

Co-Founder and Partner - Audit and Assurance

Nataniela Aldana-Sarmiento

Co-Founder and Partner - Audit and Assurance

Email: [email protected]

Telephone: +632 296 6436 / +632 253 9344

Education

Master in Business AdministrationUniversity of Santo Tomas

España Manila Philippines (ongoing)

Bachelor of Science in Commerce

Major in Accounting

University of the East

Caloocan City Philippines (1992)

Q. What do you like most about audit?

Validation of interviews through verification and translating the audit impact into figures.Q. What do you find most valuable in your audit work as Partner of ASCPA?

Getting known by clients for adding value to their business. The impact is more pronounced when you feel they are happy with your work and the impact of your solutions is for the Company's long term well-being.Q. What have you learned in ASCPA that is quite different from other companies you had worked for?

Emphasis on good planning and focus on the most important tasks of every project engagement.Q. What drew your interest about combining Agile with Audit?

Scheduling your work becomes more meaningful in a sense that you can get things done faster and smarter. You can see the big picture right away when discussed face to face.Q. What valuable advice can you give to our aspiring CPAs?

Be persistent in learning every accounting topic that you find difficult. Instead of ignoring it, pursue it more by reading a lot about that accounting topic. Your understanding will serve as your gateway to appreciate and correlate it with other accounting topics.Audit Experience

Aldana, Sarmiento and Company (2011-present)Diaz Murillo Dalupan, CPAs (1992-1997, 2006)

Industries Served

CooperativeEducation

Engineering and Construction

Insurance

Logistics

Manpower Services

Manufacturing

Microfinance

Non-Profit

Real Estate Development

Retail

Travel Agency

Professional Affiliations

Member, Philippine Institute of Certified Public AccountantsCertifications

Certified Public Accountant - Philippines (1992)Industries We Serve

Planning is crucial for every engagement. We put high premium on studying our client and their industry. It is our key to designing and implementing our work effectively. The more we understand their business environment, the greater the chance we can address our client's needs. Delivering our solutions is not a one and done deal. We need to understand how their industry behaves so that our solutions can meet the long term needs of our clients. We participate in the trainings, seminars, workshops, technical sessions and other related gatherings to get updated on the emerging issues and trends of the specific industry. The more we know about that industry, the greater the value we can offer the clients.

Please click each icon to know more of the specific services we provide to current and prospective customers.

People around the world are reeling the ill effects of CoVid19 to health and economy. Many of our countrymen are experiencing tough times to make ends meet due to retrenchments or business closures. Yet above all, the family's health is a top priority. We must remain on guard with social distancing and wearing of face mask and shields at all times to prevent the spread of CoVid19 for the safety of our families and friends we deeply care about. These safety measures save lives and easy to do. Embrace this new normal in our daily lives and believe me,this pandemic will past not too far from now.

People around the world are reeling the ill effects of CoVid19 to health and economy. Many of our countrymen are experiencing tough times to make ends meet due to retrenchments or business closures. Yet above all, the family's health is a top priority. We must remain on guard with social distancing and wearing of face mask and shields at all times to prevent the spread of CoVid19 for the safety of our families and friends we deeply care about. These safety measures save lives and easy to do. Embrace this new normal in our daily lives and believe me,this pandemic will past not too far from now.